Making Known the Secrets to Network Management. Raising up a new generation of professionals.

Showing posts with label NetApp. Show all posts

Showing posts with label NetApp. Show all posts

Thursday, December 27, 2012

Storage News: December 2012 Update

Oracle: Discusses Tape Storage...

Nanotube Non-Volitile Storage: Nantero NRAM ...

Dell Storage...

Emulex: Storage Network Vendor Buys Network Management Endace...

Red Hat Unites OS to Gluster Clustered Storage...

Advise from The Register: Cisco, Don't Buy NetApp...

Monday, September 24, 2012

EMC: Shakeup and Network Managment Implications

| [image courtesy: blog of Chuck Hollis, EMC VP --Global Marketing CTO] |

Changes at EMC

EMC has been going through a great deal of changes over the years.

2003-12 - [html] - EMC Purchases VMWare for Hypervisor

2004-12 - [html] - EMC Purchases SMARTS for Network Fault Management

2007-11 - [html] - EMC Purchases Voyence for VoyenceControl

2009-11 - [html] - VMWare, EMC, Cisco Announce VCE (Virtual Computing Environment) VBlock Architecture

2012-05 - [html] - EMC Purchases Watch4Net for APG

2012-06 - [html] - Cisco, NetApp Announce FlexPod Architecture

2012-06 - [html] - EMC Produces Own Blade Servers

Some of internal changes are more political rather than product infrastructural.

2012-09 - [html] - EMC CEO Succession Politics

During EMC world, Oracle was made to look like the red-headed bastard step child, while SPARC hardware probably drives more EMC storage than either company cares to acknowledge.

Implications to Network Management

EMC had normally played well in the multi-vendor environment, because they were a software and storage company - they would sell disks and software to anyone who used any vendor's equipment. This started to change in 2003.

With the acquisition of VMWare in 2003, there was an internal drive to virtualize more software in the proprietary Intel space, rather than play in the Open Systems space. With the VCE announcement, using Cisco to push into the carrier space further pressed the Open Systems vendors. In 2012, with the announcement from Cisco to partner with NetApp and EMC producing their own blades, the internal political pressure to abandon Open Systems will continue.

Ironically, historical analysis of performance, configuration, and event data from Network and Systems Management platforms drove the need for robust disk storage systems... Telecommunications Market -was one of the original Big Data platforms. Big-data using off-the-shelf network management software requires Open Systems (with massive vertical [socket-count] and horizontal [blade-count] scalability.) No robust system implemented under traditional Open Systems platforms would be done, without external EMC storage. The push away from Open Systems platforms (to lower-end Linux & Windows platforms) ironically drives EMC storage out of the solutions... yet this [increasingly] is the direction from EMC.

Will the investment of Open Systems management tools from SMARTS, Voyence, and Watch4Net continue to be made by EMC - with the transition from EMC CEO Joe Tucci? EMC recently killed cross-vendor object storage. With VMWare CEO Paul Maritz assuming a higher profile, will the traditional EMC suffer greater loss in their EMC Network Management and EMC storage customer bases? Pat Gelsinger, president and COO of EMC's Information Infrastructure Products, became CEO of VMware, which may offer greater influence for Open Systems management in VMWare's proprietary Intel sphere.

|

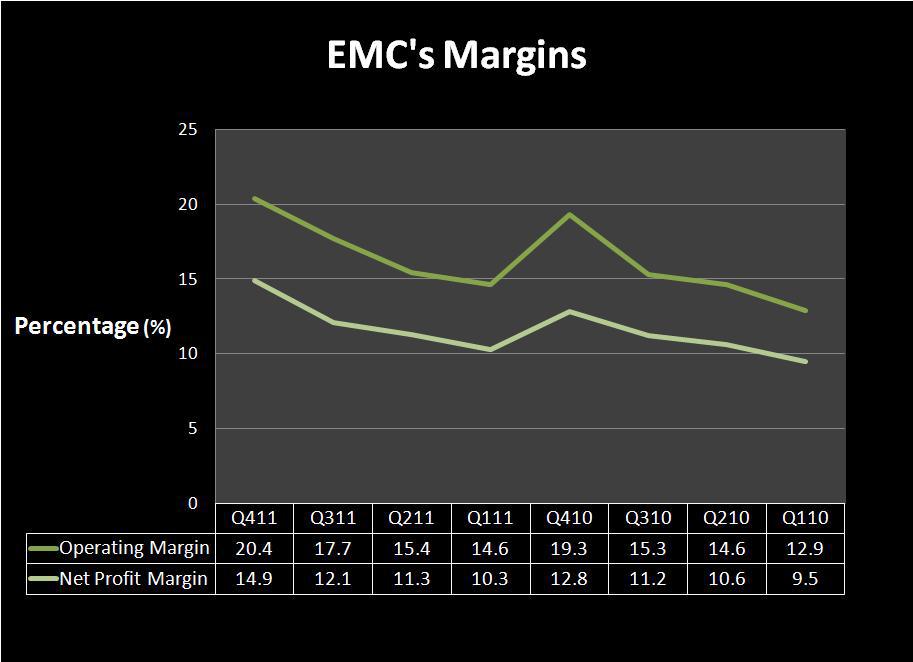

| [Graph courtesy: seekingalpha.com article] |

Traditional Network, Systems, Storage, and Security Management may be losing the last viable multi-vendor player, as the industry consolidates into vertical, proprietary stove-piped systems. It is really EMC's choice as to whether their political structure decides to carry the Open Systems banner and say "we are different - we manage everything on everything" (and are worth the premium we charge) or whether they choose to lose the moral high ground offered by Open Systems and suffer the lower profit margins of a solely proprietary Intel platform [which offers no marketing differentiation.]

|

| [Tombstone of Elizabeth in Yangzhou courtesy: wikimedia.org] |

Wednesday, June 20, 2012

EMC: Building The Cloud, Kicking Cisco Out?

EMC: Building The Cloud, Kicking Cisco Out?

Abstract:

EMC used to be a partner in the Data Center with a close relationship with vendors such as Sun Microsystems. With the movement of Sun to create ZFS and their own storage solution, the relationship was strained, with EMC responding by suggesting the discontinuance of software development on Solaris platforms. EMC purchased VMWare and entered into a partnership with Cisco - Cisco produced the server hardware in the Data Center while EMC provided VMWare software and with EMC storage. The status-quo is poised for change, again.

EMC World:

Cisco, being a first tier network provider of choice, started building their own blade platforms, entered into a relationship with EMC for their storage and OS virtualization (VMWare) technology. EMC announced just days ago during EMC World 2012 that they will start producing servers. EMC, a cloud virtualization provider, a cloud virtual switch provider, a cloud software management provider, a cloud storage provider, has now moved into the cloud server provider.

Cisco Response:

Apparently aware of the EMC development work before the announcement, Cisco released FlexPods with NetApp. The first release of FlexPods can be managed by EMC management software, because VMWare is still the hypervisor of choice. There is a move towards supporting HyperV, in a future release of FlexPods. There is also a movement towards providing complete management solution through Cisco Intelligent Automation for Cloud. Note, EMC's VMWare vCenter sits as a small brick in the solution acquired by Cisco, including NewScale and Tidal.

NetApp Position:

NetApp's Val Bercovici, CTO of Cloud, declares "the death of [EMC] VMAX." Cisco has been rumored to have been in a position to buy NetApp in 2009, 2010, but now with EMC marginalizing Cisco in 2012 - NetApp becomes more important, and NetApp's stock is dropping like a stone.

Cisco, missing a Server Hardware, Server Hypervisor, Server Operating System, Tape Storage, Disk Storage, and management technologies, decided to enter into a partnership with EMC. Why this happened, when system administrators in data centers used to use identical console cables for Cisco and Sun equipment - this should have been their first clue.

Had Cisco been more forward-looking, they could have purchased Sun and acquired all their missing pieces: Intel, AMD, and SPARC Servers; Xen on x64 Solaris, LDom's on SPARC; Solaris Intel and SPARC; Storage Tek; ZFS Storage Appliances; Ops Center for multi-platform systems management.

Cisco now has virtually nothing but blade hardware, started acquiring management software [NewScale and Tidal]... will NetApp be next?

Recovery for Cisco:

An OpenSolaris base with hypervisor and ZFS is the core of what Cisco really needs to rise from the ashes of their missed purchase of Sun and unfortunate partnership with EMC.

From a storage perspective - ZFS is mature, providing a near superset of all features offered by competing storage subsystems (where is the embedded Lustre?) If someone could bring clustering to ZFS - there would be nothing missing - making ZFS a complete superset of everything on the market.

Xen was created around the need for OpenSolaris support, so Xen could easily be resurrected with a little investment by Cisco. Cloud provider Joyent created KVM on top of OpenSolaris and donated the work back to Illumos, so Cisco could easily fill their hypervisor need, to compate with EMC's VMWare.

Abstract:

EMC used to be a partner in the Data Center with a close relationship with vendors such as Sun Microsystems. With the movement of Sun to create ZFS and their own storage solution, the relationship was strained, with EMC responding by suggesting the discontinuance of software development on Solaris platforms. EMC purchased VMWare and entered into a partnership with Cisco - Cisco produced the server hardware in the Data Center while EMC provided VMWare software and with EMC storage. The status-quo is poised for change, again.

[EMC World 2012 Man - courtesy: computerworld]

EMC World:

Cisco, being a first tier network provider of choice, started building their own blade platforms, entered into a relationship with EMC for their storage and OS virtualization (VMWare) technology. EMC announced just days ago during EMC World 2012 that they will start producing servers. EMC, a cloud virtualization provider, a cloud virtual switch provider, a cloud software management provider, a cloud storage provider, has now moved into the cloud server provider.

Cisco Response:

Apparently aware of the EMC development work before the announcement, Cisco released FlexPods with NetApp. The first release of FlexPods can be managed by EMC management software, because VMWare is still the hypervisor of choice. There is a move towards supporting HyperV, in a future release of FlexPods. There is also a movement towards providing complete management solution through Cisco Intelligent Automation for Cloud. Note, EMC's VMWare vCenter sits as a small brick in the solution acquired by Cisco, including NewScale and Tidal.

[Cisco-NetApp FlexPod courtesy The Register]

NetApp Position:

NetApp's Val Bercovici, CTO of Cloud, declares "the death of [EMC] VMAX." Cisco has been rumored to have been in a position to buy NetApp in 2009, 2010, but now with EMC marginalizing Cisco in 2012 - NetApp becomes more important, and NetApp's stock is dropping like a stone.

[former Sun Microsystems logo]

Cisco's Mishap:Cisco, missing a Server Hardware, Server Hypervisor, Server Operating System, Tape Storage, Disk Storage, and management technologies, decided to enter into a partnership with EMC. Why this happened, when system administrators in data centers used to use identical console cables for Cisco and Sun equipment - this should have been their first clue.

Had Cisco been more forward-looking, they could have purchased Sun and acquired all their missing pieces: Intel, AMD, and SPARC Servers; Xen on x64 Solaris, LDom's on SPARC; Solaris Intel and SPARC; Storage Tek; ZFS Storage Appliances; Ops Center for multi-platform systems management.

Cisco now has virtually nothing but blade hardware, started acquiring management software [NewScale and Tidal]... will NetApp be next?

[illumos logo]

Recovery for Cisco:

An OpenSolaris base with hypervisor and ZFS is the core of what Cisco really needs to rise from the ashes of their missed purchase of Sun and unfortunate partnership with EMC.

From a storage perspective - ZFS is mature, providing a near superset of all features offered by competing storage subsystems (where is the embedded Lustre?) If someone could bring clustering to ZFS - there would be nothing missing - making ZFS a complete superset of everything on the market.

[SmartOS logo from Joyent]

SGI figured out they needed a first-class storage subsystem, and placed Nexenta (based upon Illumos) in their server lineup. What Cisco really needs is a company like Joyent (based upon Illumos) - to provide storage and a KVM hypervisor. Joyent would also provide Cisco with a cloud solution - a completely intregrated stack, from the ground on up... not as valuable as Sun, but probably a close second, at this point.

Thursday, September 9, 2010

ZFS: NetApp and Oracle Agree to Dismiss Lawsuits

ZFS: NetApp and Oracle Agree to Dismiss Lawsuits

Background:

There has been a lot of Fear, Uncertainty, and Doubt spewed around by marketing droids about the use of ZFS because of lawsuits filed between NetApp and Sun.

Announcement:

Since the purchase of Sun by Oracle, this seems to have come to an end. Both NetApp and Oracle agreed to dismiss lawsuits and people can use open-source ZFS free and clear of legal wranglings.

Network Management:

Performance management typically requires immense quantities of space that is needed to hold historical performance metrics of devices and communication links. ZFS is the best tool on the market to do this efficiently, cost effectively, and securely.

Now, there should be no inhibitions to making network management business run less expensively and more efficiently.

Subscribe to:

Posts (Atom)